How will my UK pension be taxed in France? Retiring to France

If you are planning to retire in France, you’ve made a good choice, it’s the perfect place to enjoy your retirement. Most people rely on their pensions to cover their living expenses, and it’s important to understand how your UK pension income will be taxed in France once you become resident there.

Doing this research before you move helps you plan ahead, avoid unwelcome surprises, and gives you the opportunity to establish the most tax-efficient option for your circumstances and aims.

GENERAL RULES FOR UK PENSIONS

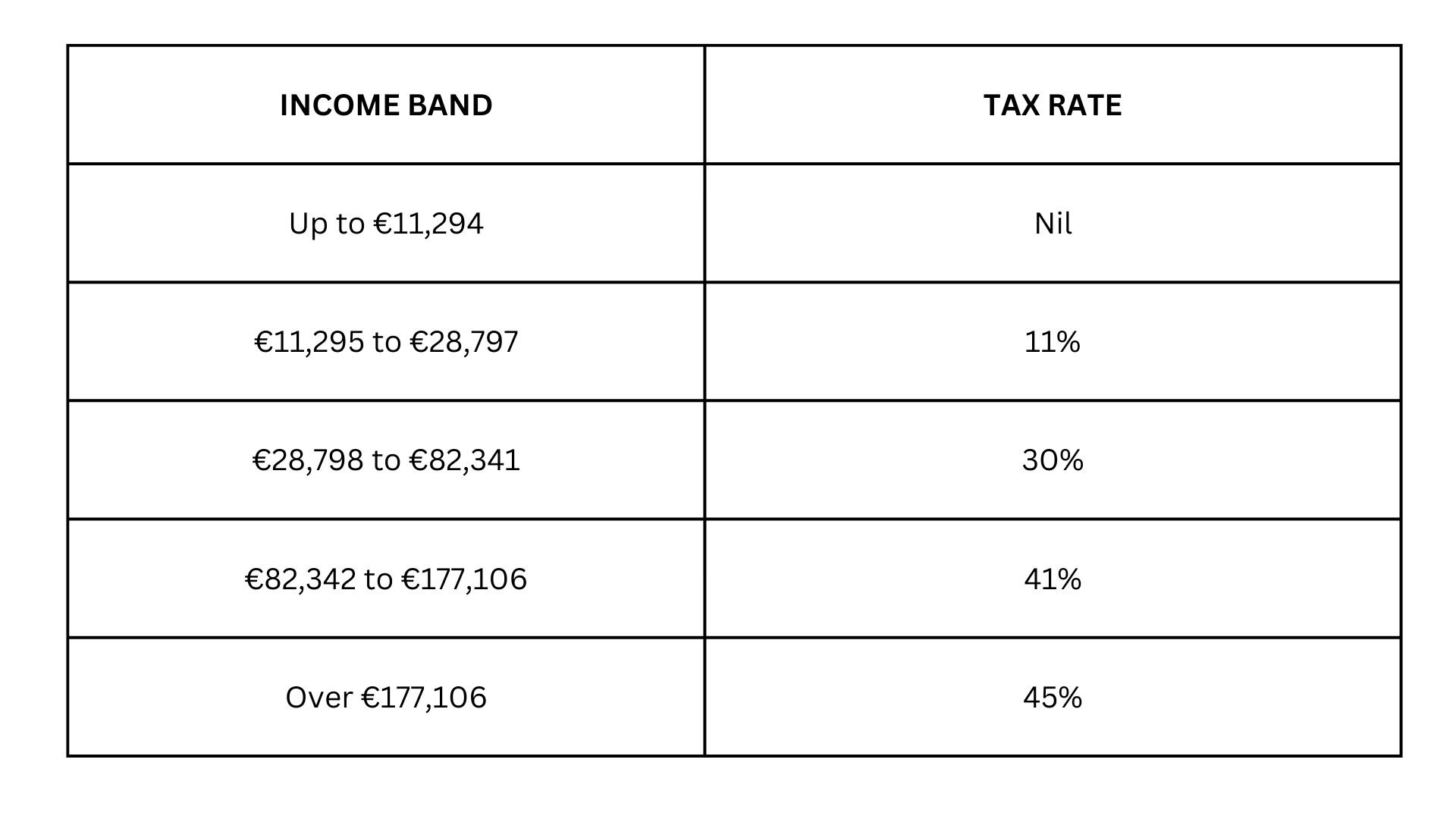

Under the terms of the UK/ France double taxation treaty, UK pension received by French residents is taxed in France, not in the UK. The exception is government services pensions. Under French domestic law, retirement and disability pensions are taxed in a similar manner to salaries. You receive a 10% deduction (minimum €442 and maximum €4,321) per household, then pay tax at the scale rates of income tax. Currently (so for 2023 income as rates are released in arrears) French income tax rates are

France taxes the household, rather than individuals. Tax is calculated on the number of household members – parts familiales. This beneficial system reduces overall tax if one spouse has a higher income than the other or you have dependants living with you. Note that France applies a second tax on income social charges. They are levied on all types of income and used to finance France’s social security (but are separate from social security contributions). The rate for pensions is 9.1%. If, however, you have a Form S1 and/or are not affiliated to the French social security system, you do not pay social charges on UK pension income.

UK STATE PENSIONS

A UK state retirement pensions is always taxable in France (except UK government service pensions), as above. It will be paid gross in the UK, so you just pay tax in France, but be aware that it can affect PAYE coding notices for any other income that remains UK taxable.

PERSONAL AND WORK PENSIONS

Personal/company/ occupational pension schemes are taxed as a pension and are liable to French income tax and social charges. They are not taxed in the UK.

UK pension companies normally deduct tax at source, so you need to arrange for them to pay it gross to avoid double taxation. In order for them to do this, you need to prove that you are tax resident in France and paying tax there.

HM Revenue & Customs has a form for this purpose: ‘France Individual DT”. You can download it from the HMRC website and then file it with your local French tax authorities, normally along with your first French tax return, before sending it to HMRC. HMRC then advises your pension provider to pay your income gross and reimburse any tax deducted at source in the interim.

GOVERNMENT SERVICE PENSIONS

If a pension arises from government employment, UK tax is always payable, regardless of the country of residence.

Although UK government pensions are not taxed directly in France, you still need to include the income on your France tax return. You then receive a credit equal to the French income tax and social charges that would have been payable (this applies even if no actual tax is paid in UK since it’s covered by the personal allowance). While you effectively don’t pay tax in France, the income could push you into a higher tax band.

Note that NHS pensions do not generally count as government service (although they can be if paid directly by a local authority). HMRC has a list stating which pensions are taxed as government service and which aren’t.

ANNUITIES

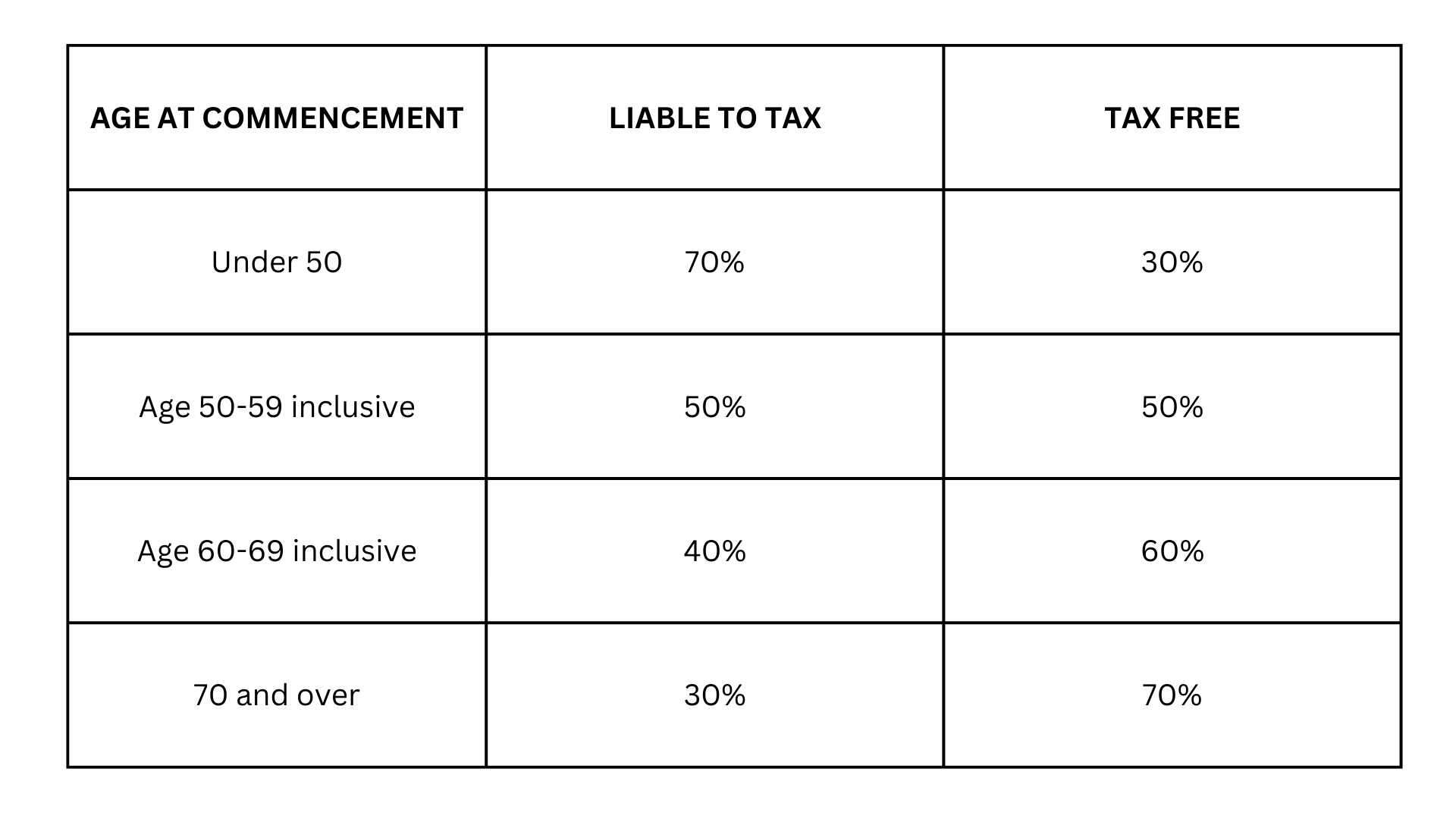

If your pension meets the ‘whole of life annuity’ definition in France – an amount resulting from a contract freely concluded by an individual who has voluntarily agreed to transfer part of his property (movable or immovable) in compensation for income he will receive gradually a portion of the income is free of tax and social charges (17.2% since it is classed as investment income) based on your age when the annuity started (see below).

It is very unlikely that the French tax authorities would allow the annuity treatment for any type of UK pension, unless it’s a genuine annuity.

LUMP SUMS

While UK rules allow you to take a 25% ‘pension commencement lump sum’ tax free, it will be fully liable to French income tax if you take it after becoming resident in France, and potentially social charges. If you haven’t left the UK yet, you’ll want to decide whether to take a lump sum or not before you move to France.

If, however, you are considering taking your entire pension as one lump sum, in certain circumstances you may be eligible for a fixed 7.5% income tax rate in France. This rate would be available where the pension contributions were made into a contributory pension scheme and the whole pension fund is taken at once.

If this applies to you, it can present opportunities. You could re-invest the capital into a tax-efficient arrangement in France and pay less tax overall. But first carefully consider if such a move would be suitable and safe for your circumstances and objectives.

QROPS

While this article focuses on how UK pensions funds are taxed, many expatiates move their pensions into a Qualifying Recognised Overseas Pensions Schemes (QROPS) for the benefits they offer. There is no issue with French taxation though, as they are taxed the same as UK personal pensions.

YOUR OTHER RETIREMENT SAVINGS

Investment income, such as interest, dividends, capital gains and gains from life insurance policies, is taxed at a fixed rate of 30% rather than the scale rates of income tax.

While social charges on investment income is normally 17.2%, the 30% flat rate covers both income tax and social charges. If you are covered by Form S1, the rate reduces to 20.3% since you don’t need to pay one of the social charges.

France offers compliant opportunities for effective tax planning. Assurance-vie, for example, is a popular savings arrangement in France. This specialised form of life assurance allows you to hold a wide range of investment assets and is highly tax efficient. It can also offer estate planning benefits.

FINDING THE BEST OPTION FOR YOU

There is no one-size-fits-all solution for taking your UK pension in France. Many people are better advised to leave their pension in the UK, while others benefit from moving their funds out of the UK into a Qualifying Recognised Overseas Pension Scheme (QROPS).

An alternative is to cash in your pension and reinvest the funds, for example, in a tax-efficient assurance-vie. You need to explore all the options, taking account of your circumstances, aims and risk tolerance, and weigh all the pros and cons.

Deciding what to do with your pension could be one of the most important financial decisions you make, so it is important not to rush into any decisions. It’s a complex, specialist area, so professional advice is essential. Your adviser will need to understand and be fully up to date on both the UK and French tax rules and the interaction between them.

Rob Kay is a Senior Partner at Blevins Franks

Share to: Facebook Twitter LinkedIn Email

More in Pensions, Retirement